Things to keep in mind while reading:

The exponential fiat currencies debasement by central banks will lead to hyperinflation. All fiat currencies of the past went to 0 and so will the one we have now. Simply because they are printed out of thin air by extreme sociopaths that have as only goal to make the elite richer, safer and more powerful. Not true? So why the more the government intervene in every aspect of the economy/society the more the wealthiest accumulate wealth? This is, a not debatable, certainty.

Governments will try every way possible to keep the faith in their fiat currencies. They will come after every competitors, including all cryptos. Doesn’t matter how decentralised is your crypto as long as they can know who is the wallet owner. Decentralization without privacy is meaningless.

If you believe the status quo will not abuse your privacy more and more in order to keep together their entropic system you are dumb and this is a certainty too. Looks at what they were able to accomplish with a bad flu.

MONERO (XMR) is a leading cryptocurrency with a focus on private and censorship-resistant transactions. The openly verifiable nature of most cryptocurrencies (such as BTC and ETH) allows anybody in the world to track your money. Furthermore, links between your financial records and personal identity may jeopardize your safety.

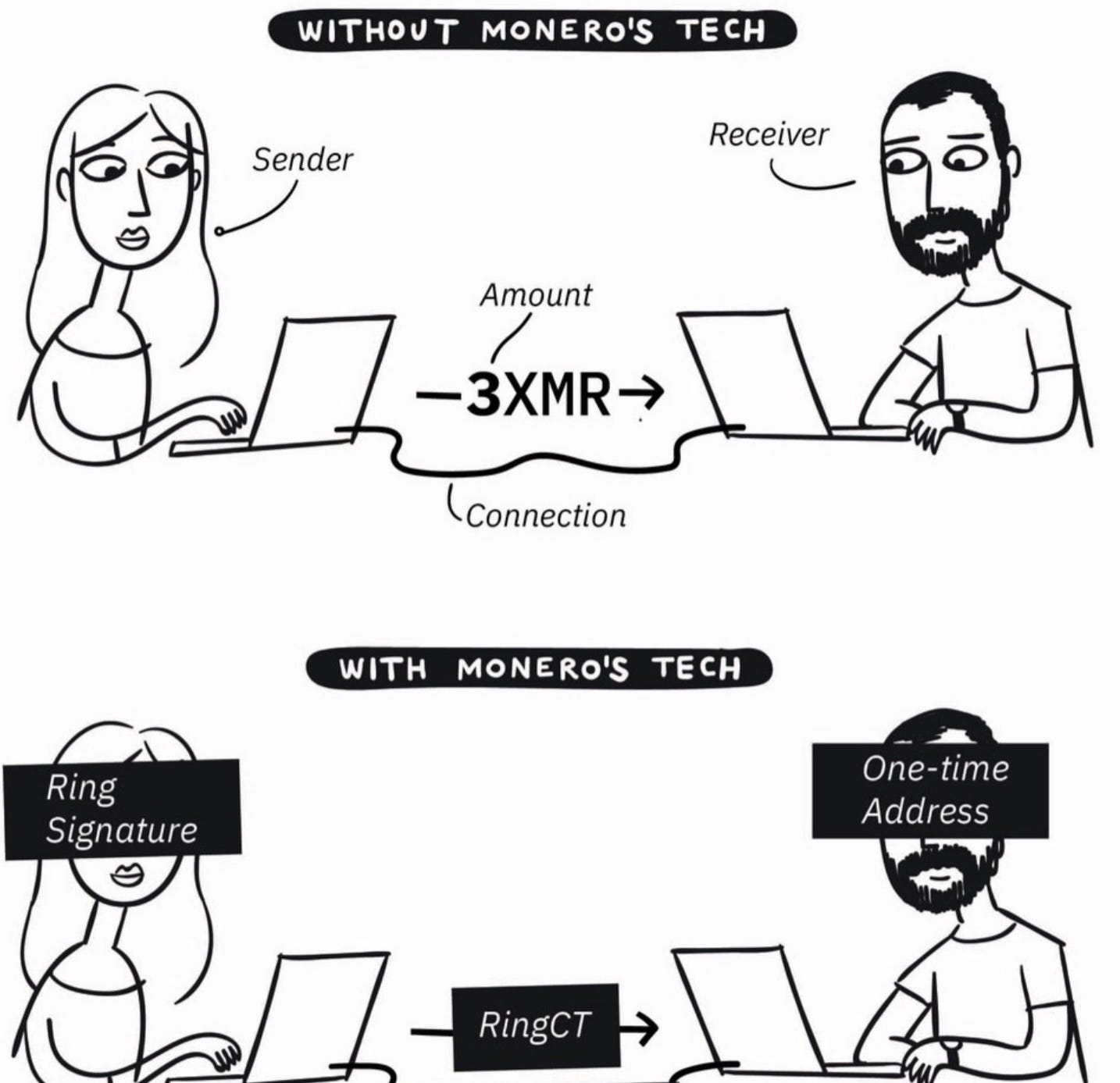

To avoid these dangers, Monero uses powerful cryptographic techniques to create a network that allows parties to interact without revealing the sender, recipient, or transaction amounts. Like other cryptocurrencies, Monero has a decentralized ledger that all participants can download and verify for themselves.

However, a series of mathematical tricks are used to conceal all of the sensitive details and stymie any blockchain tracking. Monero's privacy features allow the network to assess the validity of a transaction and determine whether or not the sender has a sufficient account balance, without the actually knowing the transaction amount or account balances! Nobody can view others' account balances, and transactions do not reveal the source of the funds being transferred.

One of XMR's crucial defining features is its enforced privacy by default. Users are specifically prevented from initializing transactions that are accidentally or intentionally insecure. This provides Monero users with peace of mind since the network will not accept a revealing transaction! Monero users reap all the benefits of a decentralized trustless financial system, without risking the security and privacy downsides of a transparent blockchain.

Monero is designed with the following principles in mind:

Network and mining decentralization: The Monero network and ledger are distributed globally. There is no single server or database that can be maliciously hacked, controlled, or censored. If one government were to shut down Monero nodes in their country, or attempt to limit who can send/receive Monero, the effort would be in vain. The rest of the world will maintain the network and continue processing transactions. While many coins have embraced application-specific integrated circuits (ASICs) and the Monero community has taken a contrarian view. RandomX is an algorithm that takes ASIC resistance one step further. It is designed to be ASIC resistant by using random code execution and memory-hard techniques to prevent specialized mining hardware from dominating the network. Because RandomX is optimized for general purpose CPUs, the network is more decentralized and egalitarian in the distribution of block rewards. ASICs are the clear target of RandomX, but since it’s optimized for CPUs, GPUs also suffer.

Financial security: The Monero network is self-secured by incorruptible cryptographic mechanisms, so there is no need to trust a third party with responsibility over your funds and transactions. Every single Monero participant can verify the validity of the ledger themselves, so you do not even need to trust the node operators.

Financial privacy: Most blockchain systems achieve strong security at the expense of privacy. However, XMR prioritizes providing total privacy with no security concessions. Transaction amounts, sender identity, and recipient identity are all obfuscated on the blockchain, so your Monero storage and spending activities are not trackable.

Figure above shows how these complementary features work together to protect sensitive transaction details:

• RingCT conceals the transaction amount.

• Ring signatures protect the sender by obfuscating which output was spent.

• Stealth address ensure that the recipient's address is not recorded on the blockchain.

Fungibility: The term fungibility refers to assets whose units are considered indistinguishable and interchangeable.. For example, imagine that you let your neighbor borrow 1 kilogram of flour for a cake. When they return flour the next week, of course it will be 1 kilogram of flour from a different source (since they used your original flour for baking). This is not a problem, since flour is fungible. However, vehicles are not fungible; if you let your neighbor borrow your car, you probably want the same one back. In the case of XMR, its fungibility is a feature of its sophisticated privacy practices. The obfuscated transaction record obscures the history of all Monero. If you let your friend borrow 1 Monero, they can return any 1 Monero, since they're indistinguishable. This particular quality may seem like a minor nuance; however, fungibility is crucially necessary for most practical uses of any currency. This characteristic is absent from most cryptocurrencies, with transparent ledgers and trackable histories.

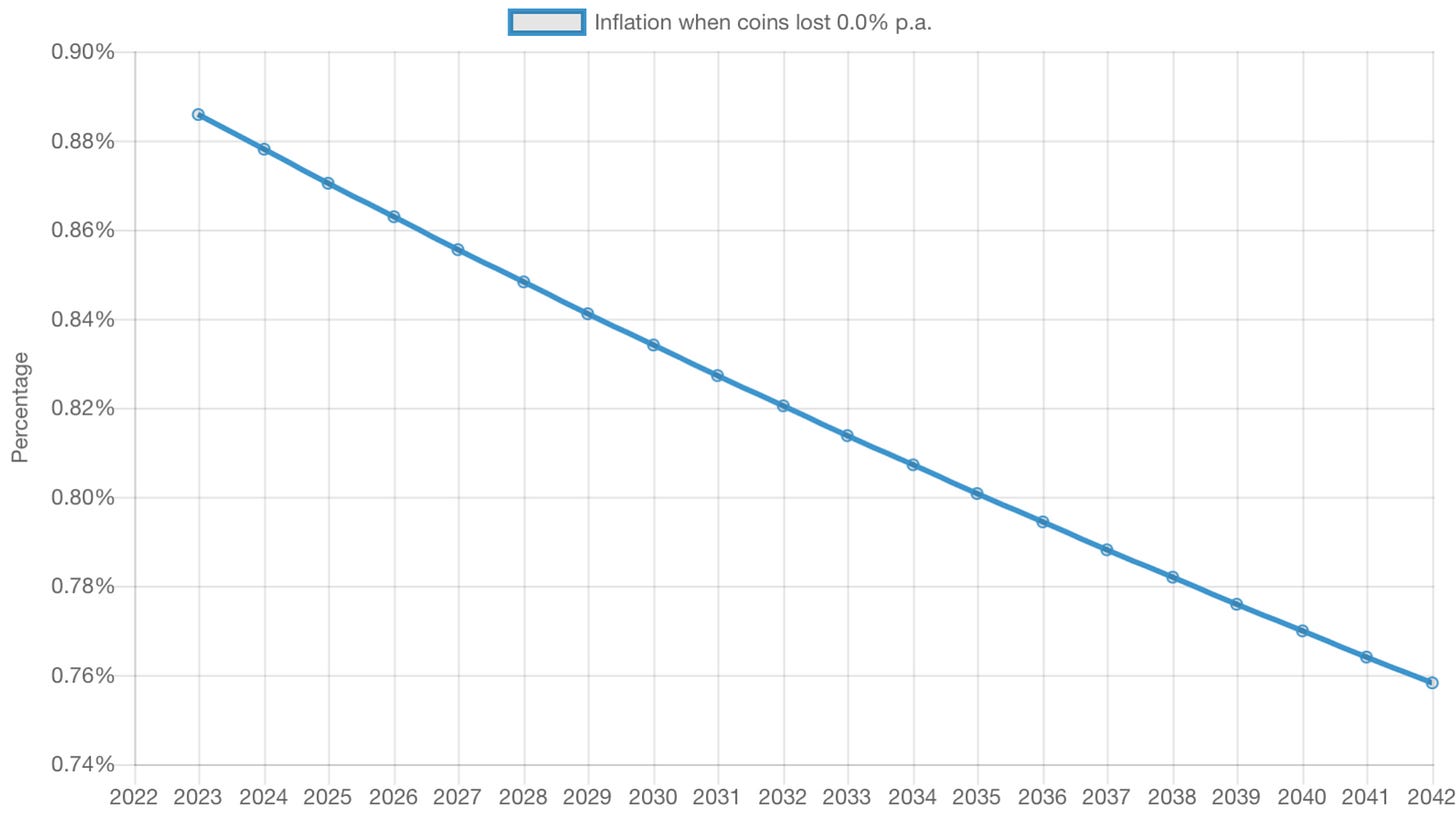

Inflation proof: Monero supply and tail emission. Tail emission means block rewards will never drop to zero. They will gradually drop until tail emission commences at the end of May 2022. At this point, rewards will be fixed at 0.6 XMR per block. Inflation wise we can see the effect in the chart below:

As we can see inflation will be substantially less than gold (circa 1.5%) and tend to 0 over time. Further the above calculation suppose no Monero will be ever lost which is highly improbable, hence the real inflation rate is going to be even lower.

Why tail emission and not a finite supply like Bitcoin? Miners need an incentive to mine. Because of the dynamic blocksize, competition between miners will cause fees to decrease. If mining is not profitable due to a high cost and low reward, miners lose their incentive and will stop mining, reducing the security of the network. Tail emission ensures that a dynamic block size and fee market can develop.

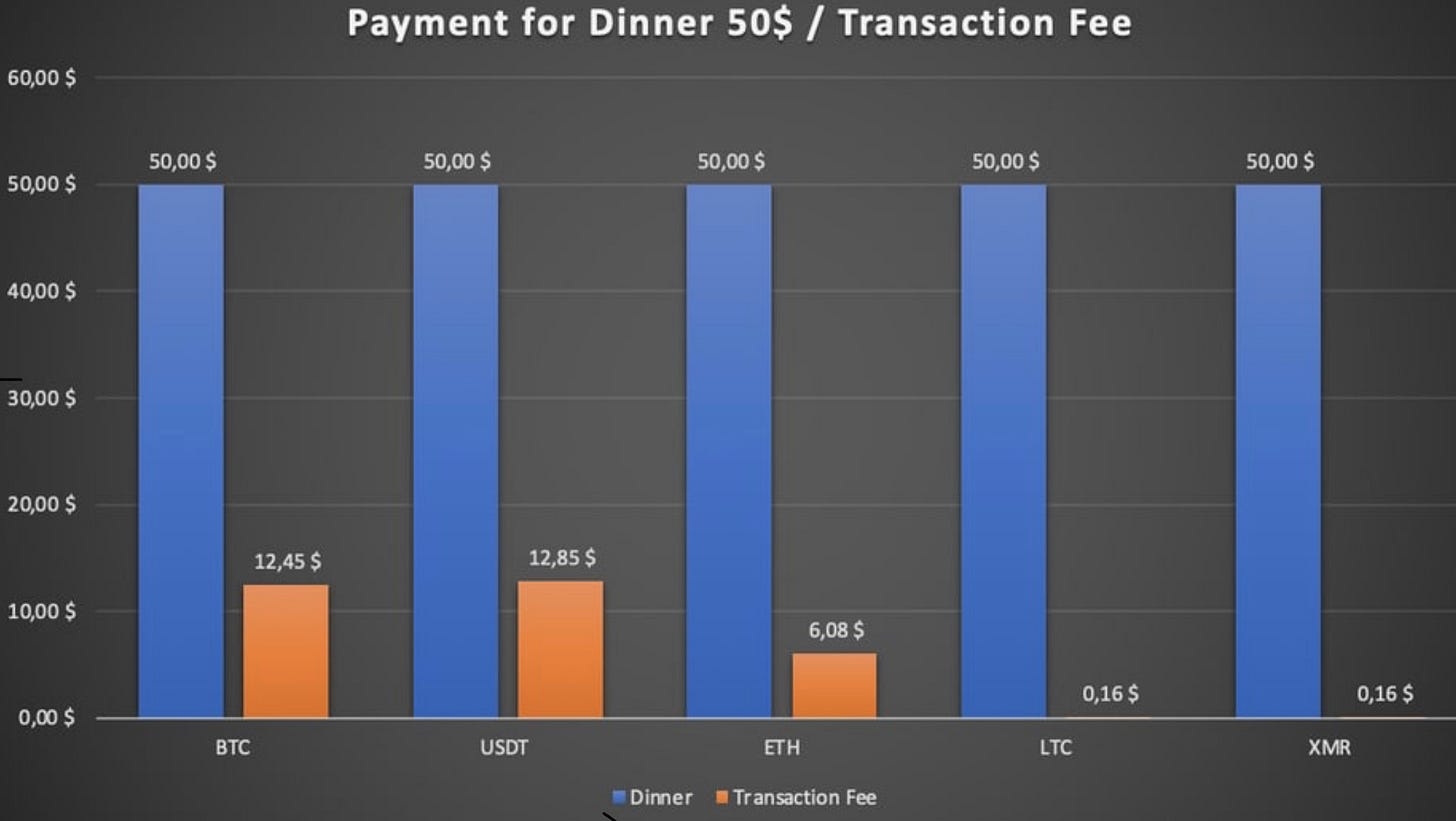

Low transaction cost: the Monero confidential transaction protocol requires the use of a zero-knowledge range proving system. Because inputs and outputs in Monero transactions have their value hidden, it's necessary to secretly prove that they represent valid amounts to avoid overflows that would fool the protocol's balance checks. The constructions used for range proving have evolved over time. Originally, the Monero protocol used a variation of ring signatures for this purpose; however, the resulting proofs were very large and slow to generate and verify, leading to slow synchronization of the blockchain and a large amount of chain bloat. This was overhauled after the release of Bulletproofs, a much more efficient range proving system. With Bulletproofs, range proofs are much smaller and faster to verify. Further, multiple proofs can be verified at the same time in a batch, leading to even more efficient synchronization i.e. low cost transactions.

The following graphic provides a good overview among payment means

Risks that arise from using transparent cryptocurrencies

For simplicity, the examples refer to “Bitcoin” as the prototypical transparent blockchain currency. However, these drawbacks are present in essentially all cryptocurrencies.

• Price manipulation: Sofia is the only mechanic in a small town. One of her customers paid for an oil change with Bitcoin. Sofia later looked up his address on the ledger and saw that the customer's wallet contained enough Bitcoin for a new Lamborghini. Next time he needed a repair, she doubled her prices. If the customer had used Monero, Sofia would have been unable view his balance or use such information to manipulate prices.

• Financial surveillance: Maria’s parents send him some Bitcoin to pay for textbooks, then continue to snoop on his Bitcoin address and activity. A few months later, Oleg sends some leftover Bitcoin to the public donation address for an organization that does not align with his parents' political views. He does not realize that they are still monitoring his Bitcoin activity until he receives a furious email from his parents, berating him. If Oleg had used Monero, his family would not have been upset due to prying into his transaction activity.

• Supply chain privacy: Frank owns a small business providing family catering services for local events. A large food company uses blockchain tracing to identify most of his regular clients. The corporation uses this list to contact Frank's customers, offering similar deals for 5% less. If Kyung-seok's business used Monero instead, its transaction history could not have been exploited by rival businesses seeking to steal his customers.

• Discrimination: Ramona finds her dream apartment, conveniently close to her new job in a great neighborhood. Every month, she promptly pays her rent in Bitcoin. However the landlord notices that some of the payments track back to a legal online casino. The landlord personally despises gambling, and unexpectedly chooses to not renew Ramona's lease. If Ramona paid rent with Monero instead, the landlord would not be able to review its history and discriminate based on her legal source of income.

• Transaction security/privacy: Sven sells a guitar to a stranger, and gives the buyer a Bitcoin address from his long-term savings wallet. The buyer checks the blockchain, sees the large sum of money that Sven has saved up, and consequently robs him at gunpoint. If Sven had instead given a Monero address for payment, the buyer would not have been able to view Sven's wealth.

• Tainted coins: Loki sells some of his artwork online to save up for college. When he pays tuition, he is shocked to receive a “payment INVALID” error from the school. Unbeknownst to Loki, one of his paintings was purchased using some Bitcoin that was stolen during an exchange hack the previous year. Since the school rejects any payment from a blacklist of “tainted” Bitcoins, they refuse to mark the bill “paid.” Loki is in an extremely difficult position: the Bitcoin that he saved has already been transferred out of his account, yet the tuition bill is still unpaid. This entire situation would have been avoided if Loki sold his paintings for Monero instead, since its fungibility precludes tracking or blacklists.

Real example

These examples have shown how Monero’s privacy features keep users safe from snooping family, tainted coins, and unethical business practices. All cryptocurrencies are a relatively new technology, and there is no such thing as “perfect privacy.” If keeping a particular payment secret is a matter of life and death, it may be risky to use any cryptocurrency for that transaction.

Financial support from worldwide criminal organisations

No wonder every good XMR proposals is funded quickly. Also XMR has the third highest numbers of devs in the crypto space after BTC and ETH. They have deep pockets and really want XMR to operate soundly because it allows their businesses to operate easier. Having such big and capable forces backing the project is an insane advantage. And never forget that the righteous politicians you entrust are sponsored by criminal organisations too.

The community

The community behind XMR is nothing short of amazing. Highly educated in tech and finance. Hardcore believers in freedom and privacy with tendencies toward the Austrian economic thought. I see a lot of volunteers willing to devolve their time and skill in order to contribute to the project success. They are well aware that the battle with governments is on the horizon and unavoidable. Not like Bitcoiners who naively believe governments will simply let BTC take over the world monetary system and giving up, without fight, the supreme power of printing.

Risk

Two main risks here:

Tech risk, a better privacy coin comes along

Governments war on XMR. There is nothing more scary for the status quo than something like XMR: a true working alternative monetary system where strong anonymity protects participants from every possible coercion. Therefore expect a live or die war. In fact it is already banned from most centralised exchanges and IRS offered a USD625k recently double at USD1.25m bounty to anyone who can break Monero. Luckily the XMR community ingenuity is amazing and they already offer alternatives like localmonero.co where XMR can be traded for fiats anonymously or atomic swaps which is a smart contract technology that enables the exchange of one cryptocurrency for another without using centralized intermediaries, such as exchanges.

Conclusion

Monero allows you to be your own bank. A cryptocurrency needs to be anonymous, permissionless and decentralized in order to function as stateless money. Therefore, the only cryptocurrency that can currently function and survive as money is Monero. This grassroots financial empowerment can be one of the greatest invention of mankind that could destroy the status quo massive competitive advantage (print money) and so level the plain field for every individuals on the planet.

In conclusion, Monero is hope.

Part of the article is from Mastering Monero book. A must read for the XMR intrigued.